Get This Report on Paul B Insurance Medicare Advantage Agent Melville

It appears good sense to state that we'll all require even more healthcare as we age. However relatively healthy and balanced senior citizens acquiring an MA plan at age 65 can't see later on to the health and wellness problems they may contend age 85. When the more major illness start is when seniors on Medicare Advantage prepares beginning paying a lot more out-of-pocket, according to Goldberg.

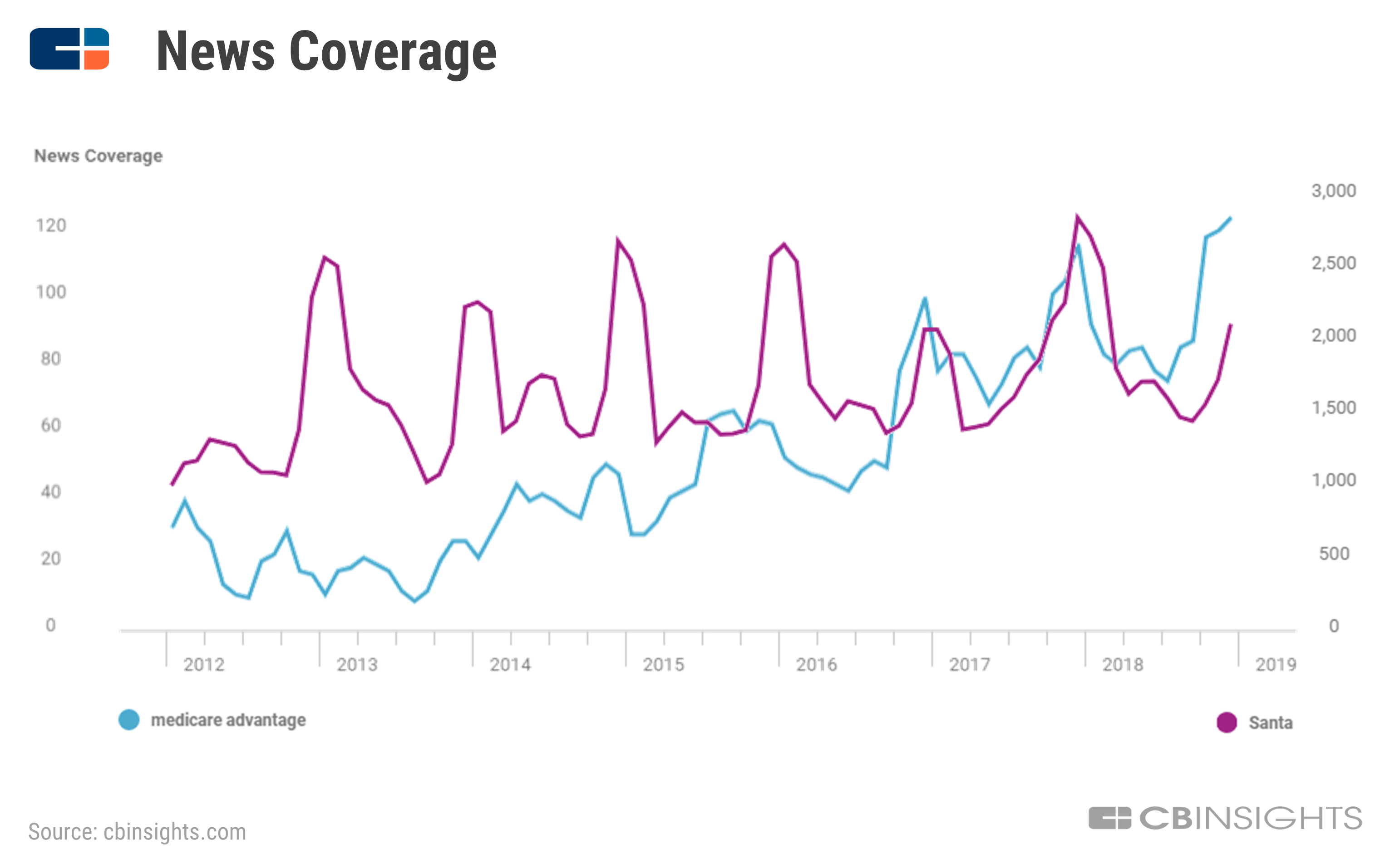

"Individuals are going to take Medicare Advantage due to the fact that on the surface area it appears excellent," she claimed. United, Health care, the nation's largest insurance provider, is amongst those payers which have the biggest Medicare Benefit enrollment.

He launched this declaration: "United, Health care provides an unequaled portfolio of Medicare coverage choices so individuals can discover a plan that fits their one-of-a-kind wellness, way of life and budget plan demands. Both our Medicare Benefit and Medicare Supplement strategies are several of the highest-rated by consumers, and also we are relentlessly dedicated to paying attention to those we offer in order to develop items that fulfill their needs and assumptions for easy, affordable coverage and also an extraordinary member experience.

Get This Report about Paul B Insurance Local Medicare Agent Melville

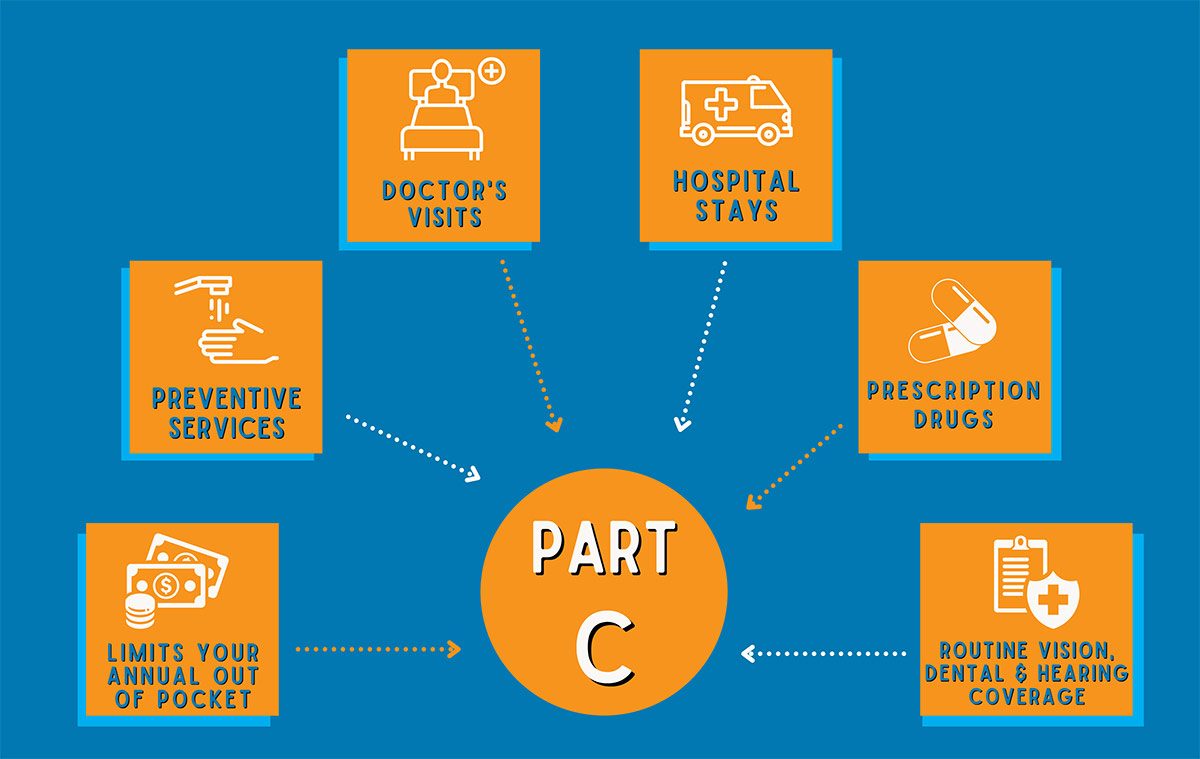

Medicare Advantage plans likewise top your optimum out-of-pocket expenditures for Component C covered services. Original Medicare includes Part An as well as Part B. Part A covers a hospital stay, home care, and also various other inpatient medical requirements (paul b insurance medicare health advantage melville).

If you're still working, you may not have the ability to use your Medicare Advantage benefits with a company health and wellness plan. Finding the best Medicare Advantage strategy may be worth it for the added protection. Be certain to ask the best inquiries to obtain one of the most out of the strategy you pick.

If you require medications, are they offered and budget-friendly under a selected strategy? A reduced out-of-pocket maximum might be more effective, so you have coverage for unexpected injuries or illnesses.

Examine This Report on Paul B Insurance Local Medicare Agent Melville

These plans are offered by insurer, not the federal government., you must additionally get approved for Medicare Components An and B. You can take a look at the chart above for a refresher course on qualification. Medicare Advantage strategies additionally have certain solution locations they can provide insurance coverage in. These solution areas are certified by the state and also approved by Medicare.

Many insurance policy strategies have an internet site where you can examine if your doctors are in-network. Keep this number in mind while reviewing your different plan alternatives.

You can see any service provider throughout the U.S. that accepts Medicare. You can still obtain eye treatment for clinical problems, but Original Medicare does not cover eye exams for glasses or get in touches with.

Examine This Report on Paul B Insurance Medicare Supplement Agent Melville

Numerous Medicare Advantage intends deal fringe benefits for oral treatment. Lots of Medicare Benefit intends offer fringe benefits for hearing-related services. But you can purchase a separate Component D Medicare drug strategy. It is uncommon for a Medicare Benefit plan to not consist of medicine protection. You can have dual protection with Initial Medicare and various other Click This Link coverage, such as TRICARE, Medigap, veteran's advantages, employer plans, Medicaid, etc.

You can have various other twin insurance coverage with Medicaid or Unique Requirements Plans (SNPs).

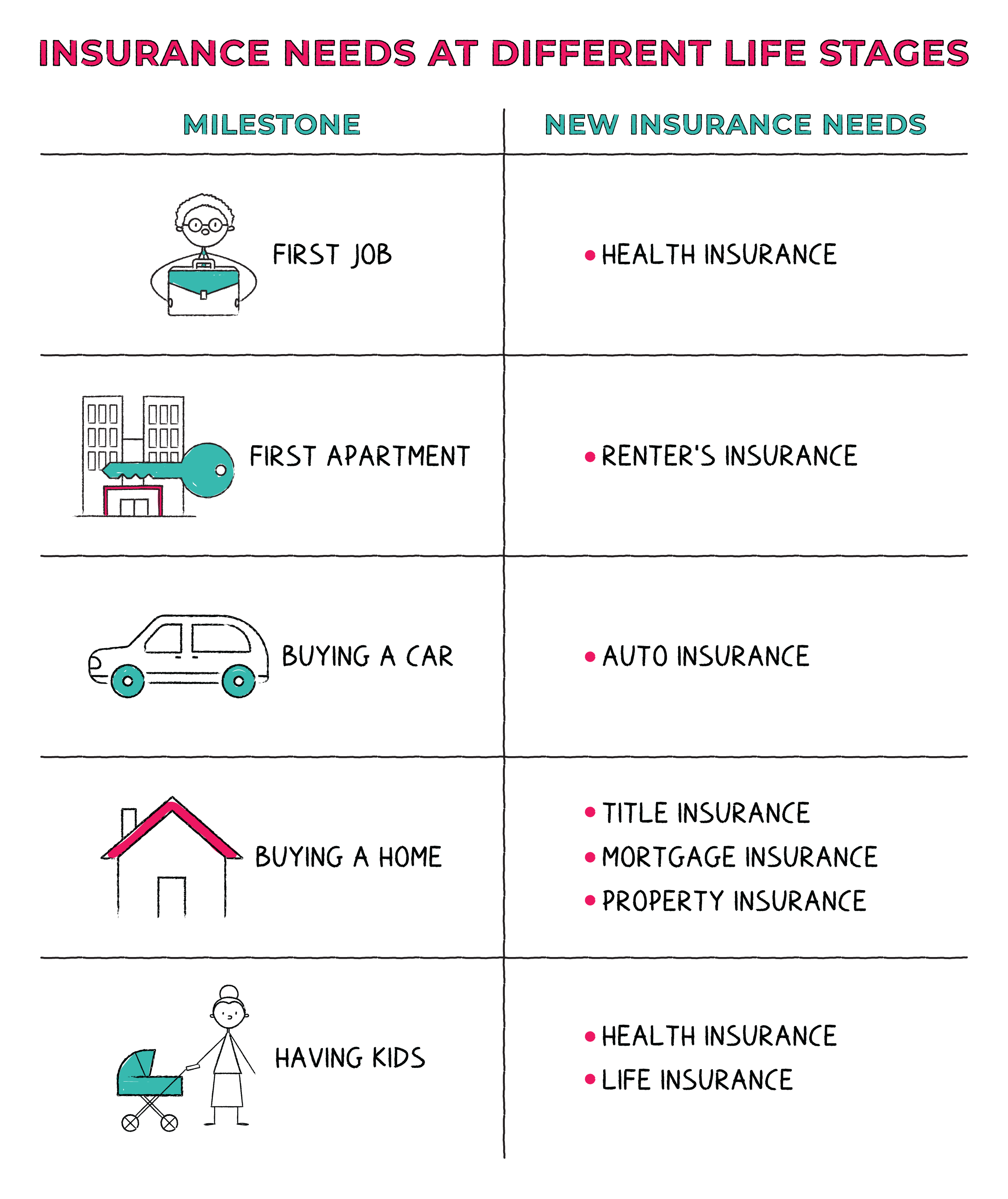

When selecting your Medicare protection, you ought to consider strategy expenses, plan doctors, ease, your way of living and your existing healthcare needs. Your health is very important to us, as well as we're pleased to use a selection of Medicare Advantage Plans that provide you the extensive full coverage car insurance protection you need together with the top quality, neighborhood care you deserve.

The Ultimate Guide To Paul B Insurance Medicare Insurance Program Melville

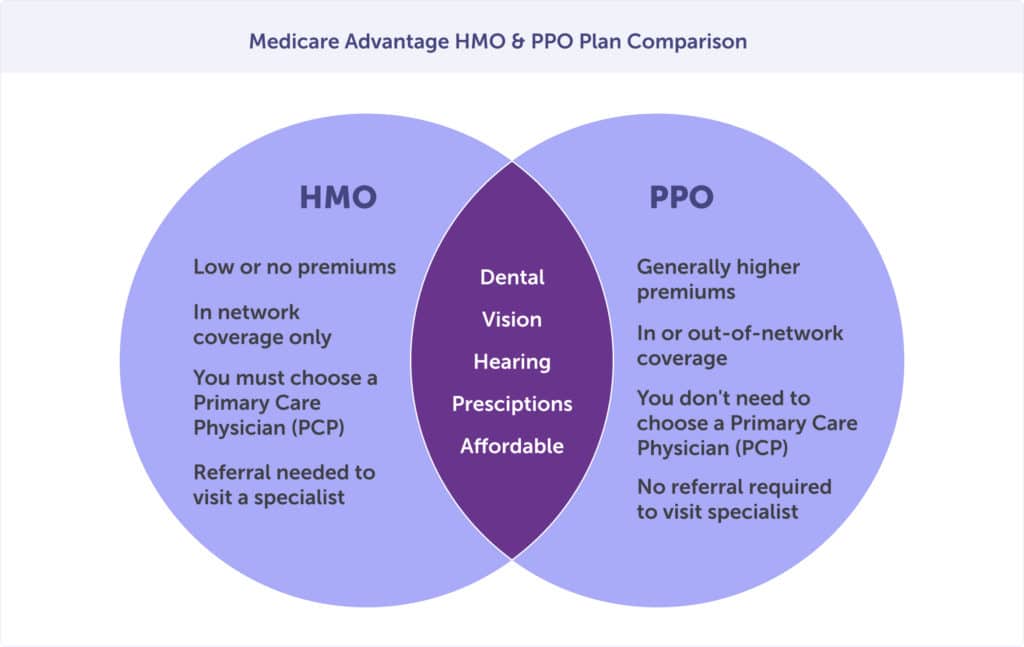

On the one hand, Medicare Advantage prepares typically offer some coverage for advantages not consisted of in traditional Medicare, such as spectacles. On the other hand, standard Medicare enables recipients to go to any type of medical professional, healthcare facility, or various other health and wellness treatment provider that approves Medicare, without the demand for prior authorization; Medicare Advantage enrollees generally require a reference from their primary treatment medical professional as well as strategy authorization if they desire services from professionals, such as oncologists, covered by the plan.

This evaluation concentrates on 1,605 participants age 65 as well as older who were signed up in Medicare. To find out more concerning our study, consisting of the modified sampling method, see "Just how We Conducted This Study.".

The 7-Second Trick For Paul B Insurance Medicare Agency Melville

Medicare is a Medical Insurance Program for: Individuals 65 years of age as well as older (paul b insurance medicare health advantage melville). Some individuals with impairments under 65 years old. Individuals with End-Stage Renal Illness (irreversible kidney failure requiring dialysis or a transplant). Medicare has four components: Part A (Health Center Insurance Coverage). Many people do not need to spend for Component A.

In the majority of Medicare took care of treatment plans, you can only go to physicians, experts, or hospitals that are component of the plan. Medicare took care of care plans supply all the long term care insurance cost advantages that Original Medicare covers.

The FEHB health insurance plan sales brochures describe exactly how they collaborate benefits with Medicare, depending upon the kind of Medicare handled treatment strategy you have. If you are eligible for Medicare protection reviewed this details very carefully, as it will certainly have a real bearing on your benefits. The Original Medicare Strategy (Original Medicare) is readily available almost everywhere in the United States.